754

754

🎯 Taxation is the first section within the Taxation and Medicare Details Accordion, and is used to define the Payee's Taxation Classification for payments. With STP Phase 2, these details are also included in all relevant Submissions.

Tax Treatment Seniors and Pensioners is applicable when the Payee is An Australian resident for tax purposes, has provided a valid Tax File Number or using a relevant Exemption Tax File Number per the Tax File Number Declaration (NAT 3092), and confirmed they are a Senior/Pensioner by completing either the Withholding Declaration (NAT 3093) or Withholding declaration – short version for Seniors and Pensioners (NAT 5072).

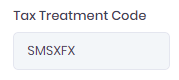

Tax Treatment Code is disabled and automatically generates a unique Identifier based on the ATO's requirements, which determines the applicable ATO Taxation Schedule for the appropriate Pay Rates, Allowances and Deductions.

If the first two identifiers are

- SM, PAYGW is calculated per Schedule 9, Member of a couple

- SI, PAYGW is calculated per Schedule 9, Member of an illness-separated couple

- SS, PAYGW is calculated per Schedule 9, Single

Income Stream defaults to Salary and Wages and allows you to select Closely Held Payee if required (an individual who is directly related to the entity from which they receive payment).

Add to Tax allows you to define the set dollar amount or the percentage of the Total Gross to be added to PAYGW in Process (Step 3 of the Pay Run).

Tax Free Threshold is disabled when Tax Treatment is set to Seniors and Pensioners.

![]()

Student and Training Support Loans (STSL) is used to define that the Payee has returned the relevant documentation to advise they are repaying a Student and Training Support Loan.

![]()

Employment Basis is based on the Payees' regularity of work and entitlement to Leave.

Seniors and Pensioners Tax Offset (SAPTO) is applicable when Tax Treatment is set to Seniors and Pensioners and reduces the amount of PAYGW, which applies to the Payee's payments.

Date Signed and Payee Signature Present? indicate the date the Payee signed and returned the physical Tax File Number Declaration to you.