236

236

Tax Treatment Horticulturists and Shearers) applies when the Payee is hired in the horticultural or shearing industry.

Tax Treatment Code is disabled and automatically generates a unique Identifier based on the ATO's requirements, which determines the applicable ATO Taxation Schedule for the appropriate Pay Rates, Allowances and Deductions.

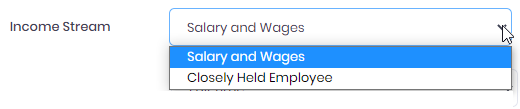

Income Stream defaults to Salary and Wages and allows you to select Closely Held Payee if required (an individual who is directly related to the entity from which they receive payment).

Employment Basis defines the regularity of work and the Payees entitlement to Leave.

Tax Free Threshold is DISABLED and unable to be de/selected when the Payees Tax Treatment is Seasonal Worker Programme.

Student and Training Support Loans (STSL) is DISABLED and unable to be selected when the Payees Tax Treatment is Seasonal Worker Programme.

Date Signed and Payee Signature Present? Indicate the date the Payee signed and returned the physical Tax File Number Declaration to you.