Nov 16, 2024

790

790

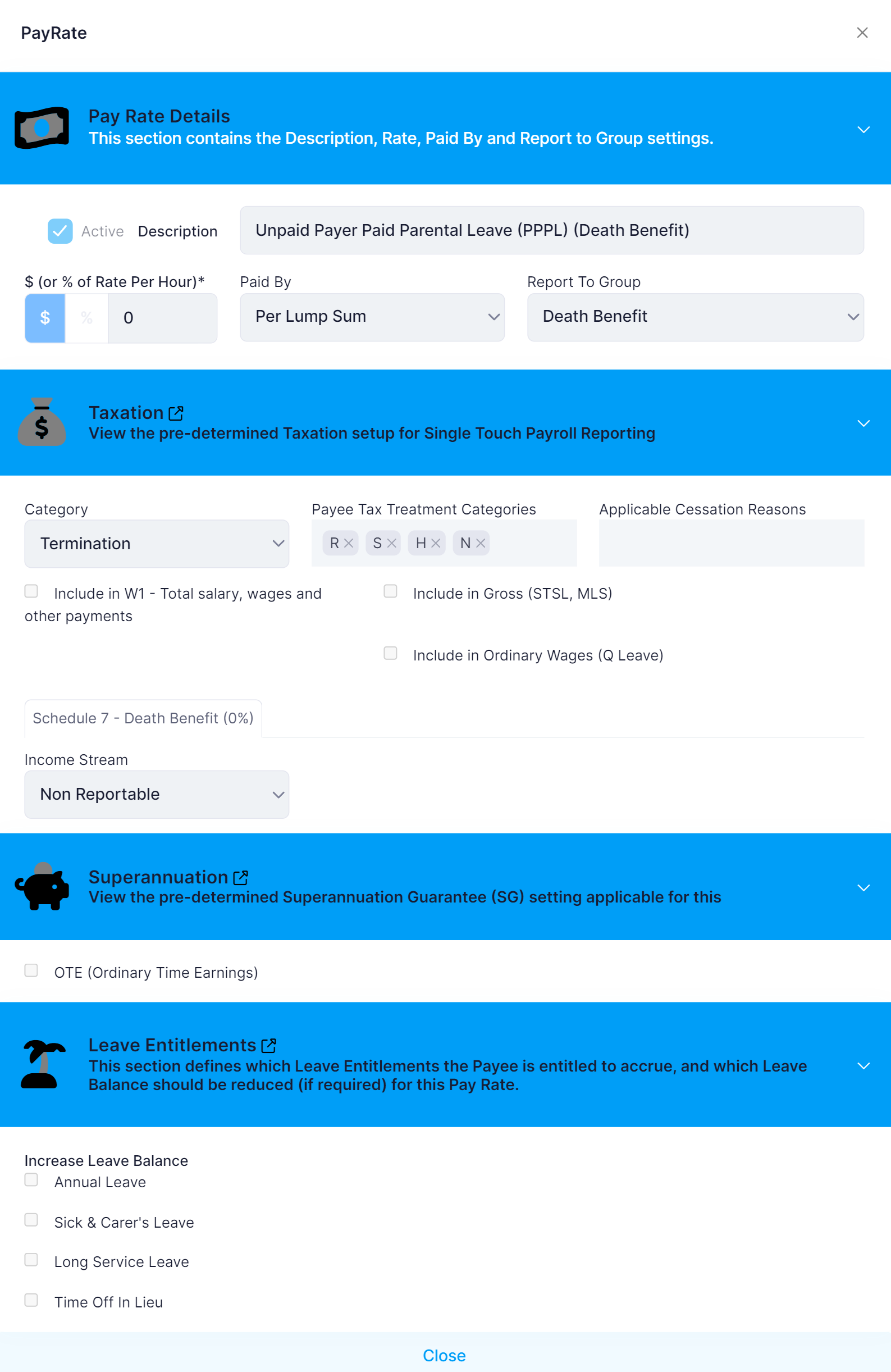

🎯 The reporting of payments for Unpaid Payer Paid Parental Leave (PPPL) (Death Benefit) has not changed per the Australian Taxation Office Single Touch Payroll Phase 1 guidance. Unpaid Payer Paid Parental Leave (PPPL) (Death Benefit) continues to be non-reportable.

🎯 If you are unsure if this Pay Type applies to your circumstances, please refer to the Payee's Employment Contract or obtain advice from either the Australian Taxation Office or Fair Work Ombudsman.

Unpaid Payer Paid Parental Leave (PPPL) (Death Benefit) is applicable when the Payee ceases employment due to being Deceased and the Payee's Death Beneficiary receives a payment for unpaid Payer Paid Parental Leave (PPPL) the payee took.

Unpaid Payer Paid Parental Leave (PPPL) (Death Benefit) uses the $ (or % of Rate Per Hour) set within the Pay Rate and Leave Entitlements are not applicable. Payments with this pay type may be considered either Taxable or Non-Taxable, however, they are not W1 (Total of Salary, Wages & other payments) or Ordinary Time Earnings (OTE).