662

662

🎯 If you are unsure if this Pay Type applies to your circumstances, please refer to the Payee's Employment Contract or obtain advice from either the Australian Taxation Office or Fair Work Ombudsman.

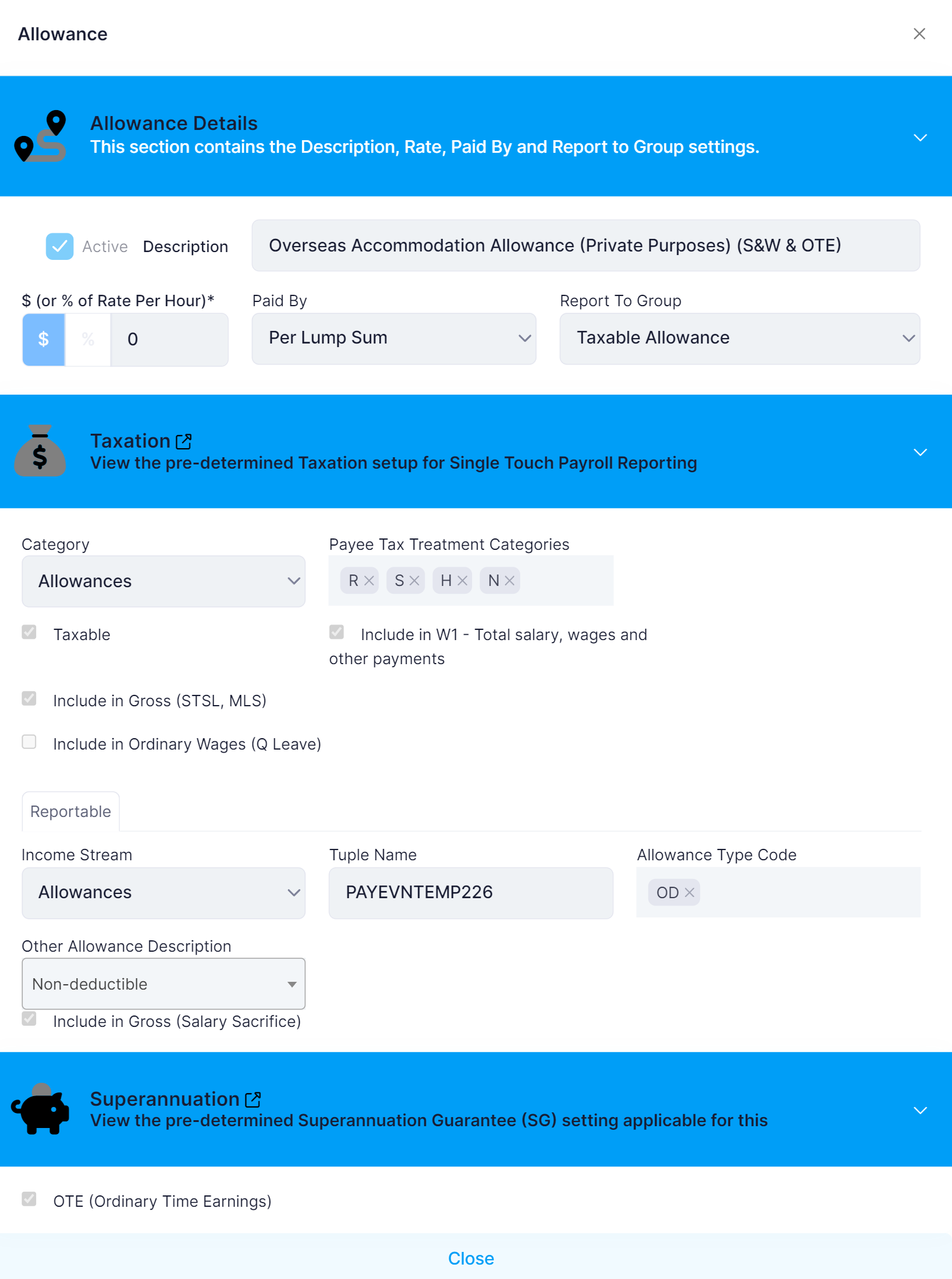

Overseas Accommodation Allowance (Private Purposes) (S&W & OTE) is applicable when the Payee is entitled to an allowance for their accommodation when travelling internationally, where the Payee sleeps away from home for private purposes.

For example, under the;

-

Electrical, Electronic and Communications Contracting Award 2020 [MA000025]. On distant work, the employer must provide reasonable board and lodging or pay a living away allowance of $536.49 per week.

-

Ports, Harbours and Enclosed Water Vessels Award 2020 [MA000052]. On distant work, the employer must provide reasonable board and lodging or pay a living away allowance of $534.02 per week.

-

Plumbing and Fire Sprinklers Award 2020 [MA000036]. On distant work, the employer must provide reasonable board and lodging or pay a living away allowance of $468.57 per week.

Overseas Accommodation Allowance (Private Purposes) (S&W & OTE) uses the $ (or % of Rate Per Hour) set within the Pay Type and Leave Entitlements are not applicable. Payments with this pay type are considered to be Salary & Wages, Taxable and Ordinary Time Earnings (OTE).